US End Game Approaching - Govt Spending More Than Twice What It Is Collecting

By Tyler Durden/Activist Post March 26, 2024

By Tyler Durden/Activist Post March 26, 2024

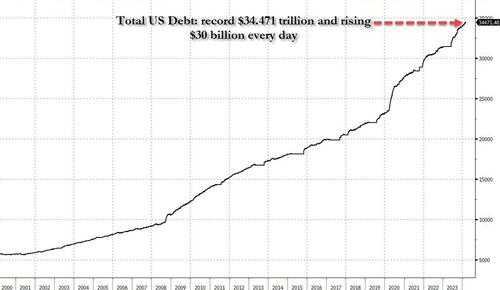

Earlier today, CNBC’s Brian Sullivan took a horse dose of Red Pills when, about six months after our readers, he learned that the US is issuing $1 trillion in debt every 100 days, which prompted him to rage tweet, (or rageX, not sure what the proper term is here) the following:

We’ve added 60% to national debt since 2018. Germany – a country with major economic woes – added ‘just’ 32%.

Maybe it will never matter. Maybe MMT is real. Maybe we just cancel or inflate it out. Maybe career real estate borrowers or career politicians aren’t the answer.

I have no idea. Only time will tell. But it’s going to be fascinating to watch it play out.

He is right: it will be fascinating, and the latest budget deficit data simply confirmed that the day of reckoning will come very soon, certainly sooner than the two years that One River’s Eric Peters predicted this weekend for the coming “US debt sustainability crisis.”

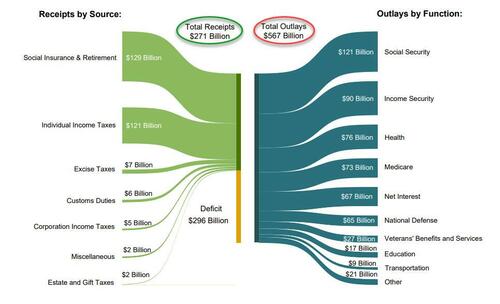

According to the US Treasury, in February, the US collected $271 billion in various tax receipts, and spent $567 billion, more than double what it collected.

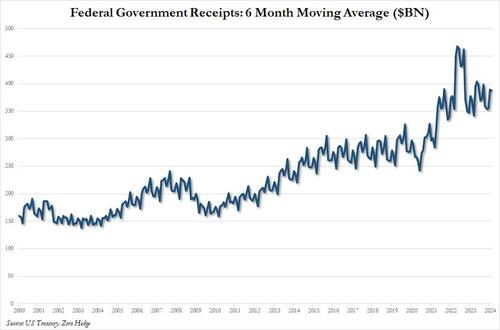

The two charts below show the divergence in US tax receipts which have flatlined (on a trailing 6M basis) since the covid pandemic in 2020 (with occasional stimmy-driven surges)…

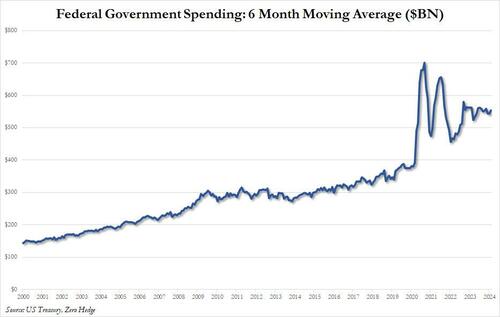

… and spending which is about 50% higher compared to where it was in 2020.

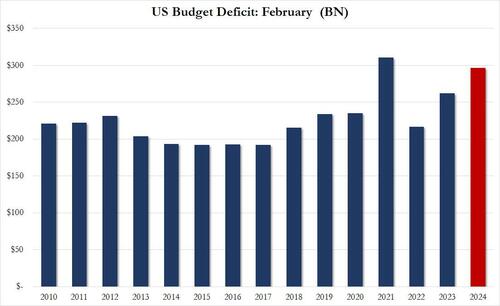

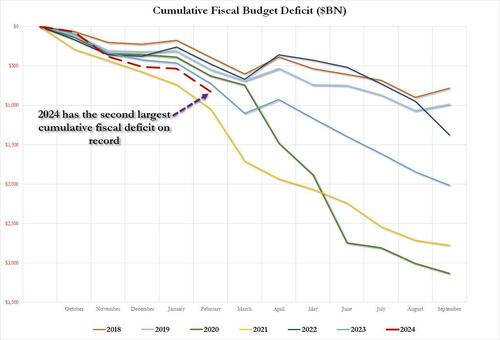

The end result is that in February, the budget deficit rose to $296.3 billion, up 12.9% from a year prior, and the second highest February deficit on record.

And the punchline: on a cumulative basis, the budget deficit in fiscal 2024 which began on October 1, 2023 is now $828 billion, the second largest cumulative deficit through February on record, surpassed only by the peak covid year of 2021.

But wait there’s more: because in a world where the US is spending more than twice what it is collecting, the endgame is clear: debt collapse, and while it won’t be tomorrow, or the week after, it is coming… and it’s also why the US is now selling $1 trillion in debt every 100 days just to keep operating (and absorbing all those millions of illegal immigrants who will keep voting democrat to preserve the socialist system of the US, so beloved by the Soros clan).

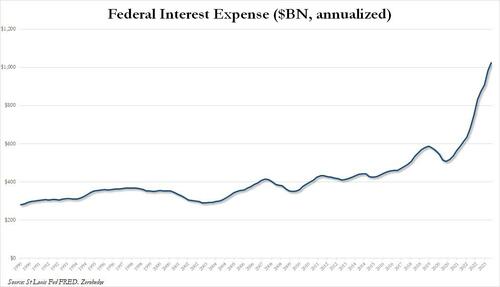

And it gets even worse, because we are now in the Ponzi finance stage of the Minsky cycle, with total interest on the debt annualizing well above $1 trillion, and rising every day

… having already surpassed total US defense spending and soon to surpass total health spending and, finally all social security spending, the largest spending category of all, which means that US debt will now rise exponentially higher until the inevitable moment when the US dollar loses its reserve status and it all comes crashing down.

We conclude with another observation by CNBC’s Brian Sullivan, who quotes an email by a DC strategist…

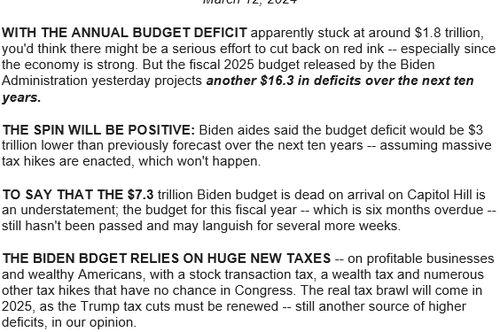

.. which lays out the proposed Biden budget as follows:

The budget deficit will growth another $16 TRILLION over next 10 years. Thats *with* the proposed massive tax hikes.

Without them the deficit will grow $19 trillion.

That’s why you will hear the 'deficit is being reduced by $3 trillion' over the decade.

No family budget or business could exist with this kind of math.

Of course, in the long run, neither can the US… and since neither party will ever cut the spending which everyone by now is so addicted to, the best anyone can do is start planning for the endgame.

Originally published at Activist Post